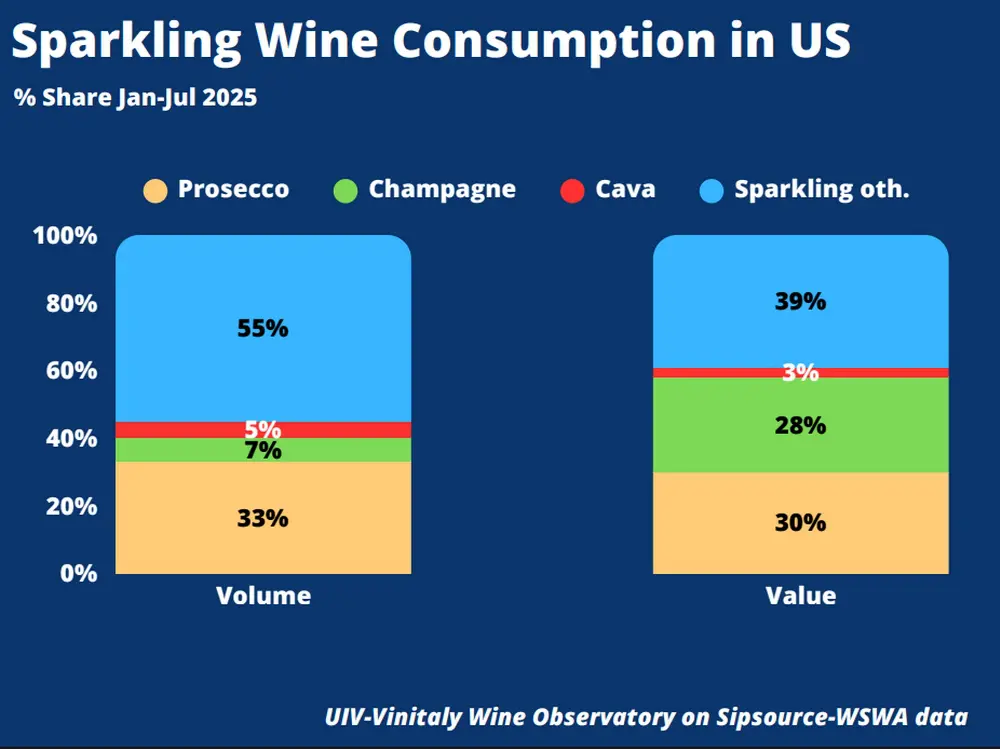

The historic overtaking in value of Prosecco PDO over Champagne in the US market took place a year ago, but even in this 2025 the sparkling wine from Triveneto confirms itself at the top of the ranking also in terms of value. In the first 7 months of this year, Italian sparkling fixed its market share within the overall sparkling category at 30%, against Champagne’s 28%. The data, contained in a focus by the Uiv-Vinitaly Observatory, released on the occasion of Vinitaly USA – scheduled for 5 and 6 October in Chicago, with 250 exhibitors including wineries and consortia – also shows that the three Prosecco PDOs (Conegliano-Valdobbiadene, Asolo DOCG and Prosecco DOC) have experienced sustained growth over the last 15 years.

Prosecco in the USA – market share January–July 2025 compared with Cava, Champagne and other sparkling wines

The record year 2024

Today, the Prosecco PDO triad accounts for 31% of the value consumption of all Italian wines marketed in the US. And with high penetration indices, starting with Millennials (27%) and reaching the female target, with 6 out of 10 consumers. Its overall value exceeds 500 million dollars, with a leap of 178% in the last 7 years. In particular, 2024 reached the record of 531 million dollars, occupying market shares in the US that are higher than the average for Italian wine (27% compared to 24%).

Higher purchase conversion rate

Prosecco PDO, as noted by the Uiv Observatory, has become a symbol of accessible drinking in the USA, with an annual consumer value of 2.9 billion dollars and average bottle prices close to 18 euros. “It is the Italian wine with the highest awareness, at 40%,” emphasised director Carlo Flamini. And while it is true that Champagne still leads the notoriety ranking (52%), Prosecco has surpassed the French in purchase conversion rate: the percentage stands at 31% compared to the transalpines’ 24%.

Very high growth margins in several States

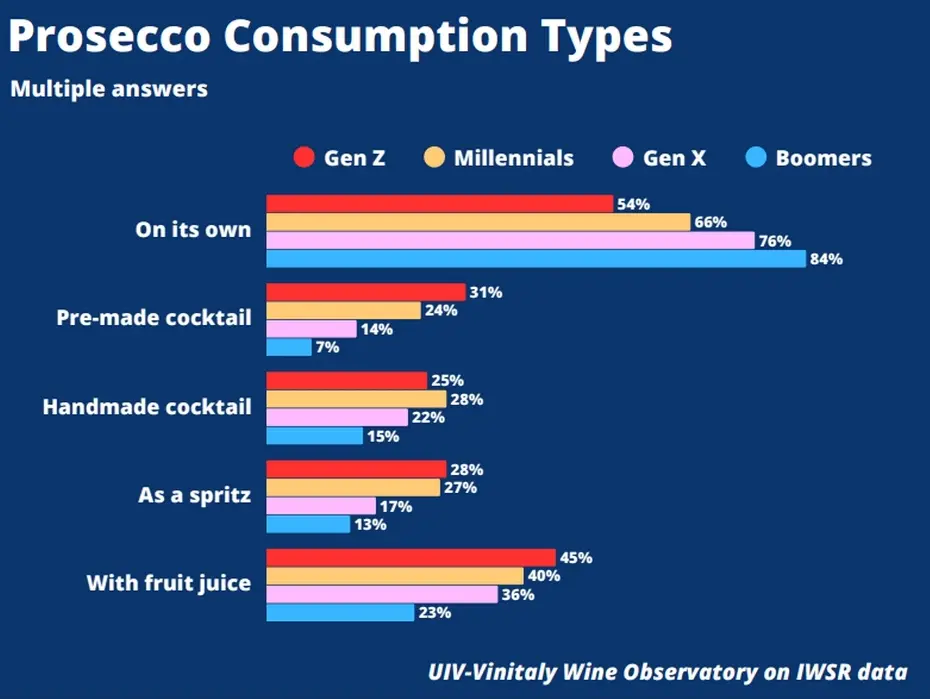

The States of the West and East North Central have the highest growth margins. According to the Observatory, user density is high throughout the eastern corridor (from New England to the Mid and South Atlantic), where more than half of total consumption is concentrated. Prosecco PDO represents 87% of Italian sparkling wine sales in the USA by value and 25% compared to total Italian wine. Not only that. According to data processed for Vinitaly, the Italian sparkling wine is also intercepting mixology trends “with a very high share of presence in cocktails”. According to IWSR data, in addition to the wine glass, formats range from ready-to-drink to freshly made cocktails, from spritz to mixes with fruit juices, particularly appreciated by women and Gen Z. In addition to the challenge of the 15% tariffs imposed under Donald Trump’s presidency, the other challenge is to win over increasingly significant American communities also at a demographic level, since the share of traditional consumers (European-Caucasian) is still high.

Adolfo Rebughini – direttore generale Veronafiere spa

“It cannot be said that in recent years there have not been extra-sector difficulties – from Covid to the decline in purchasing power and consumption, up to competition with other beverage categories – but Prosecco has demonstrated extraordinary resilience, strengthening itself thanks to a consistent valorisation strategy and increasingly effective promotional investments,” commented Adolfo Rebughini, General Director of Veronafiere.

Over 30% of Italian wine consumption in the USA is Prosecco: 15 years to crush the competition (including Champagne)

Over 30% of Italian wine consumption in the USA is Prosecco: 15 years to crush the competition (including Champagne) Tre Bicchieri 2026, the 24 best wines from the Marche awarded by Gambero Rosso

Tre Bicchieri 2026, the 24 best wines from the Marche awarded by Gambero Rosso The pastry chef who convinced Milanese people to enter a hotel just for breakfast

The pastry chef who convinced Milanese people to enter a hotel just for breakfast In Lazio a new Wine Consortium is born: it will be responsible for the protection of Cesanese di Olevano Romano

In Lazio a new Wine Consortium is born: it will be responsible for the protection of Cesanese di Olevano Romano Tre Bicchieri 2026, the 16 best wines of Emilia-Romagna awarded by Gambero Rosso

Tre Bicchieri 2026, the 16 best wines of Emilia-Romagna awarded by Gambero Rosso