It is not yet clear what the quantitative effect of the application of tariffs on Italian wines in the US market will be. But Italy knows well that this arena, the first in terms of turnover, cannot be ignored. And it also knows that trade is concentrated in about 15 States, so far led by California, New York, Florida, Texas and Illinois. Therefore, it is difficult to imagine that there is no further room for growth, despite the obstacles of tariffs decided by the White House. Italy, together with France, is a leader among wine suppliers in the USA, having exported 345 million litres in 2024, for 2.25 billion dollars. And if one looks beyond the classic destinations, there is a large alternative audience of over 113 million people who can become potential consumers. But what is the identikit of the current and future consumer? And above all, with which types of wine could Americans be won over?

The current consumer

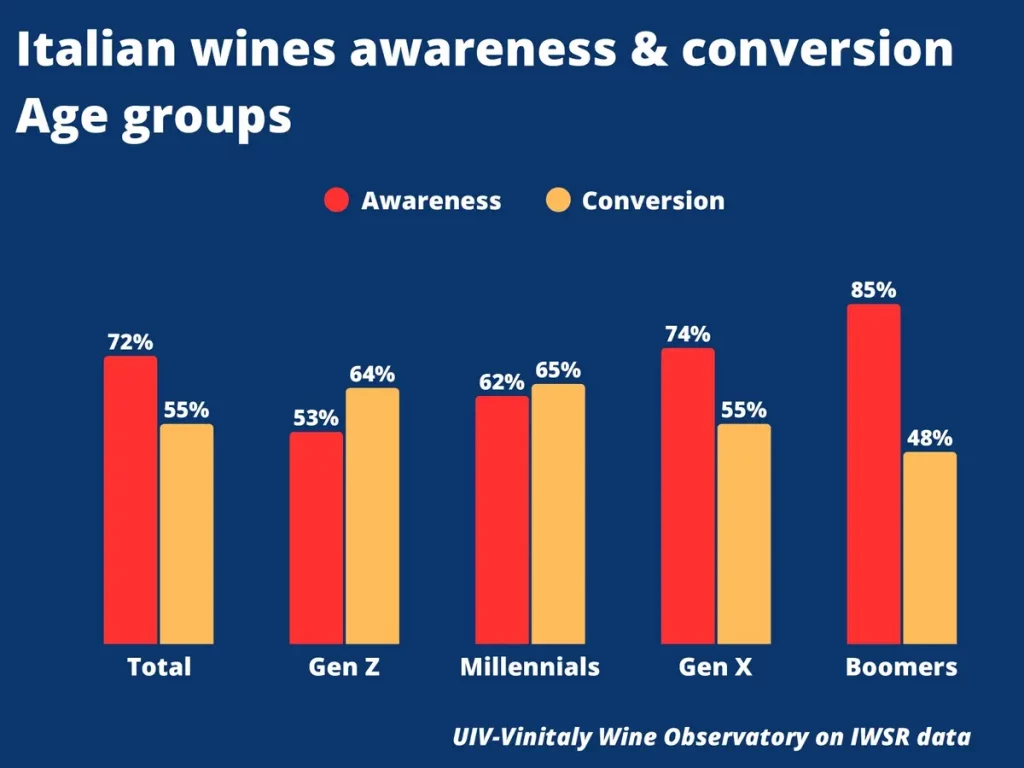

In the States considered traditional, according to an analysis by the Uiv Observatory based on Iwsr data, on the occasion of the launch of Vinitaly USA (5–6 October in Chicago), consumers of Italian wine are of European-Caucasian origin (75%), belong to the boomer or Gen X cohorts (62%), with a well-represented female audience. Wines have an average notoriety of 72% and a conversion rate to purchase of 55 per cent. By gender, in California, Florida and New York, wine consumption is more male-dominated; by ethnicity, African Americans are above average in Georgia, North Carolina and Virginia, with a prevalence of Hispanics in California and Texas. By age, Gen Z is above average in Georgia, Illinois, the Carolinas (North and South) and Texas. Millennials are more numerous, compared to the national average, in New York and Texas.

The consumer of tomorrow

The consumer of the future in the United States has, in general, a precise identikit: male, of Latin American or Afro-descendant ethnicity, residing in Texas, Illinois, California, South Carolina and Georgia, belonging to the Millennial or Gen Z cohorts. The Uiv–Vinitaly analysis highlights the importance of demographic segments currently on the rise: Hispanics, who today account for 20% of the US population and in States such as California or Texas represent half of the youth cohorts; African Americans and Asians, accounting respectively for 15% and 6% of US residents.

The buyer of the future and the right Italian wine

Looking at buyers of Italian wine only, the identikit by State emerging from the Iwsr analysis shows in California and Florida a prevalence of male, Hispanic, belonging to the Millennial cohort. For this target, the right wine would be a red, not only sparkling (such as Lambrusco, also in sweet/amabile versions) but also structured and soft still reds, such as Primitivo and Amarone.

In Georgia, Illinois and the Carolinas (South and North), the age drops to very young African Americans, with Sicilian reds (Nero d’Avola and Shiraz) but also whites such as Moscato d’Asti and sparkling wines based on moscato. In Texas too the target is young, albeit of Latin ethnicity, through Chianti and Lambrusco. There are more opportunities for Italian wines among Millennial consumers in New York and Washington thanks to white wines such as Pinot Grigio, Vermentino and Ribolla. Whereas in Ohio, the target could be Generation Z, and in Virginia African Americans.

The still unexplored States

There are areas within the United States where Italian wines are little known, with rates well below the American average. This is why, according to Vinitaly–Uiv, the potential is considerable. In the State of Arkansas, for example, Millennial consumers of Caucasian and African American origin might enjoy the mix of sparkling wines from various territories and reds based on Sangiovese (Brunello, Merlot, Tuscan IGT). In Arizona, one consumer profile to explore is female, over 40, also belonging to the Asian community, who favours structured reds such as Montepulciano d’Abruzzo.

In Louisiana, the opportunities are linked to African Americans, with a male profile, both very young and adult; in Indiana, women (again African American) of Gen X prevail. Again, in Colorado, males of Caucasian origin of Gen X are more numerous and more “sensitive” to long-lived whites, such as Soave and Verdicchio. Finally, in New Mexico, the main target is Hispanic, male and Millennial. “The data confirm an average notoriety for Italian wines of 72%,” explained Veronafiere’s CEO, Adolfo Rebughini, “and a conversion rate to purchase of 55%: a heritage which, through Vinitaly, we want to consolidate while at the same time opening up to new targets and emerging markets.”

'To be the global platform, we must take everyone and everything into account'

'To be the global platform, we must take everyone and everything into account' What did Italian producers think of Wine Paris 2026?

What did Italian producers think of Wine Paris 2026? The pizza that’s taking the Winter Olympics by storm

The pizza that’s taking the Winter Olympics by storm Where to eat in Central Rome (while avoiding the tourist traps)

Where to eat in Central Rome (while avoiding the tourist traps) The Top Italian Wines Roadshow returns to Kenya

The Top Italian Wines Roadshow returns to Kenya