The increasingly white-focused soul of Italian wine is being driven by sparkling wines, with regions showing a strong interest in the category and with denominations and Consortia promoting an expansion of sparkling production. Cultural trends leaning toward moderation, the ageing of older consumer groups, and the rise of new habits (starting with the aperitif), which have captured the tastes of younger people drawn to mixology, along with the push of major wine giants like Prosecco (especially DOC but also DOCG), have all contributed over the past twenty years to reshaping Italy’s wine identity—making sparkling wine the category with the highest growth rates in production, consumption, and exports.

The numbers behind the sparkling boom

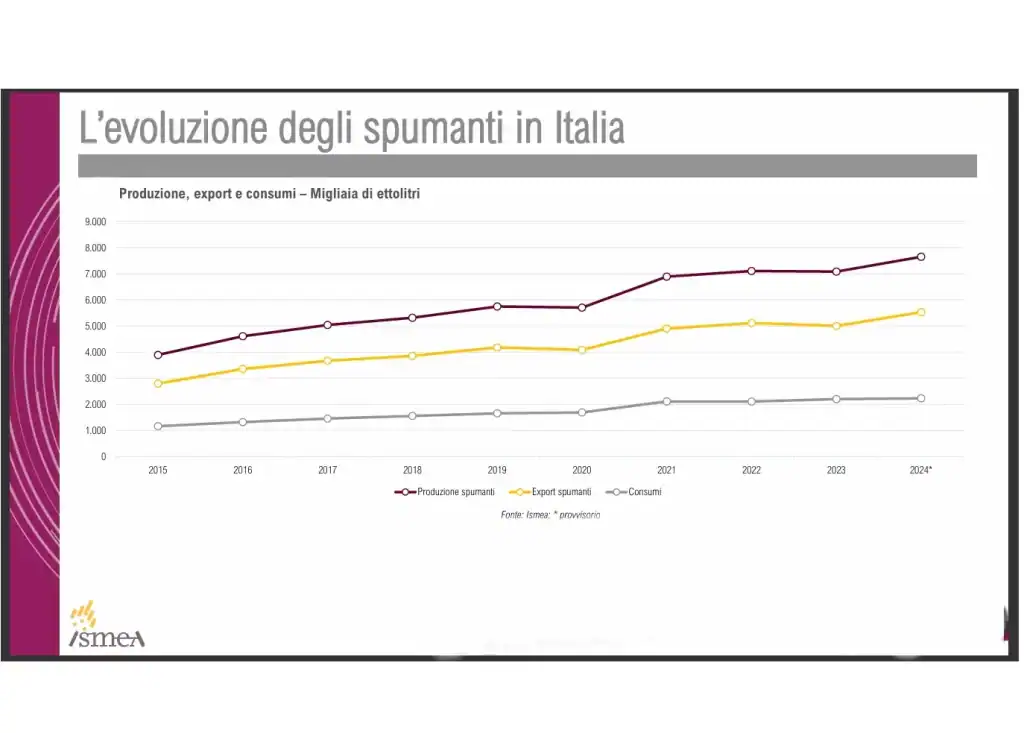

Italian sparkling wine production rose in 2024 to 7.6 million hectolitres, according to Ismea data based on Agea figures (up from 4 million hl in 2015). These volumes now account for 17% of national production, which totalled 44 million hectolitres in the same year. It’s no surprise analysts have referred to this as a phenomenon. Looking at PDO wines alone, based on 2023 data, sparkling wines occupy many top spots in Italian rankings. Prosecco DOC represents 27% of total PDO production volume, followed by DOC delle Venezie (almost 10%), Montepulciano d’Abruzzo (4.2%), Conegliano Valdobbiadene Prosecco DOCG (4.1%), Asti and Moscato d’Asti DOCG (4%), DOC Sicilia (3.8%) and Chianti DOCG (3.3%).

Evolving PDOs

Italy’s transformation can also be traced through the evolution of individual denominations. Over the past decade—and beyond—we’ve seen the well-known rise of Prosecco (which has launched a rosé sparkling version within the DOC), but also of Asolo, Franciacorta, Alta Langa, and Trentodoc. Through the Consortia, producers have shown strong interest in these categories, prompting the MASAF wine committee to repeatedly amend production specifications. Most recently, the massive Toscana IGT (95 million bottles) has begun eyeing bubbles (both classic and Martinotti method) to diversify its offering. Meanwhile, the Italian classic method sector is in full swing, beginning a truly new chapter.

From Prosecco records to Alta Langa

To name some examples, 2024 marked a record for Prosecco DOC, a denomination growing steadily for 15 years, reaching 660 million bottles (+7% compared to 2023). Still in Veneto, from 2015 to 2023, production of Asolo Prosecco Superiore DOCG jumped from 5 million to 27.5 million bottles. Since 2020, Franciacorta DOCG has also posted record volumes, hovering around 19–20 million bottles annually for nearly five years. Trentodoc, despite the challenges of 2024, is eyeing 15 million bottles. Meanwhile, in Piedmont, Alta Langa DOCG reached 3.2 million bottles in 2024, up 10% year-on-year.

A contagious sparkle across regions

Despite an overall decline in consumption (both in Italy and globally), the passion for bubbles has spread to other Italian regions. In Lombardy, a revolution has begun around Classese, a classic method from Oltrepò Pavese (where sparkling Pinot Nero has a long tradition), with the Consortium working on a new production code. In Abruzzo, there’s the collective brand initiative Trabocco. In Emilia, the merger of two protection bodies has led to the creation of DOC Emilia Romagna to reorganise and jointly promote Pignoletto (still and sparkling), a rising star in retail over the past decade, preceded in 2019 by the Romagna Wines Consortium’s Bolè project. In Piedmont, examples include Acqui DOCG Rosé, a dry version of Brachetto, and the recent Asti Rosé. In Sicily, the Etna DOC district — slowly shifting towards white grapes—has expanded its sparkling range using native varieties. Even Sardinia hasn’t resisted the charm of bubbles, experimenting with Vermentino and other native grapes through the Akinas (“grapes”) project, a sparkling wine research initiative by Sardegna Ricerche and Agris Sardegna, presented at Vinitaly 2024.

Pignoletto vineyards in Emilia-Romagna

Positive exports amid declining white and red wines

Back to the numbers. Italian sparkling wines have driven export records for years. And in 2024, as recently highlighted by a UIV Observatory analysis, they overtook red and white still wines in volume for the first time. According to Istat data, Italian sparkling wines have shown a steady upward export trend over the past decade, unlike still whites and reds, which have seen long-term declines. Between 2015 and 2024, sparkling exports rose from around 2.7 million to 5.6 million hectolitres, while whites and reds fell slightly below their levels from ten years ago—whites around 7 million hectolitres, reds around 9 million. In 2024 alone, sparkling wine exports increased 12% in volume and 8.9% in value.

Production, export, and consumption of sparkling wines in Italy – source: Ismea

Sparkling wines win with consumers

Focusing on domestic consumption in Italy, Ismea data shows that from 1 million hectolitres in 2015, sparkling wine consumption rose to over 2 million hectolitres in 2024. This thirst for bubbles is also evident in modern retail channels. In addition to Prosecco DOC, which remained the top seller in 2024, Circana data shows that last year classic method sparkling wines from Trentino (Trentodoc) and Lombardy (Franciacorta and Oltrepò Pavese) performed well, with +3.8% in volume and +6.2% in value. Meanwhile, historic denominations like Lambrusco, Chianti, Bonarda, and Sangiovese lost ground.

The North-East's contribution

Regionally, the macro wine-growing area of North-East Italy has led the charge over the past 25 years, fuelling the growth of Italian vineyards while Central and Southern Italy lost significant ground. The rise of PDOs like Prosecco and Pinot Grigio delle Venezie was crucial. Between 2000 and 2023, Veneto and Friuli Venezia Giulia increased their vineyard surface areas by 38% and 53% respectively, with both growing nearly 30% between 2015 and 2023 alone.

A revolution in Italy’s ampelographic heritage

Italy’s ampelographic heritage—long a point of pride for Italian wine—has also been transformed. Key red grape varieties have declined sharply over the same period: Sangiovese -30%, Montepulciano -53%, Merlot -39%, Negroamaro -35%, Nero d’Avola and Barbera both -9%. Meanwhile, white varieties have surged, led by Glera (up from 12,000 to 38,000 hectares), with notable increases for Chardonnay (+22%) and Moscato Bianco (+36%).

Sparkling drives global trends

Globally, the story is the same. Sparkling wines are leading the shift in the international wine market toward whites. In a year of particularly low global production—estimated at 221 million hectolitres by the OIV (International Organisation of Vine and Wine)—red wine accounted for 42% of global volume between 2019 and 2024, down from 44% in 2014–2018. Rosés grew from 8% to 9%. White wines, bolstered by sparkling types, remain the most produced—and the gap with reds is widening, with whites rising from 46% to 49%. At the turn of the century, reds held 48% of volume share versus 46% for whites. The historic overtaking happened in 2013. Today, nearly half of the wine produced worldwide is white—and much of that is thanks to Italian wines, and of course, to sparkling wines.

The Paris restaurant where a different tasting menu is served every day

The Paris restaurant where a different tasting menu is served every day 'Balance between evolution and continuity': the identity of Conti Zecca

'Balance between evolution and continuity': the identity of Conti Zecca Why the Italian wine industry should 'stick to it' in the US market

Why the Italian wine industry should 'stick to it' in the US market Langhe Nebbiolo DOC in bag-in-box: the rule change dividing producers

Langhe Nebbiolo DOC in bag-in-box: the rule change dividing producers 'Wine knowledge in Nigeria is evolving'

'Wine knowledge in Nigeria is evolving'