Months of negotiations, signed agreements and tariff changes were not enough to fuel the confusion. Now, to further complicate the picture, come the divergent interpretations of the US customs authorities, which are turning the market for Parmigiano Reggiano and Grana Padano into a regulatory maze that is hard to decipher. The result is chaos that helps neither producers nor exporters, who are called upon to plan price lists and commercial strategies in a context of fluid rules and contradictory applications.

The case erupted on 27 August, when the port customs of New York and New Jersey applied a higher-than-expected tariff on the two great Italian PDO cheeses. An “interpretation error”, as the protection consortia define it, which nevertheless risks having serious consequences on trade relations between Italy and the United States and, above all, on company finances. The Italian Ministry of Foreign Affairs, alerted by the consortia, intervened with the Tariffs Task Force, taking the first diplomatic steps with the US Embassy in Rome, the European Commission and the Italian representation in Washington.

A tariff puzzle that disorients

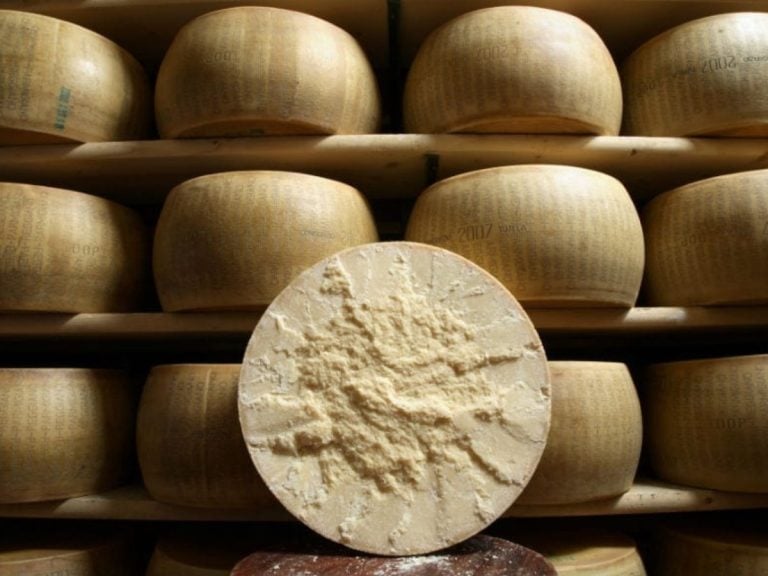

To understand the scale of the problem, it is necessary to retrace the steps of recent months. Since the 1960s, Parmigiano and Grana have paid a 15% tariff. In April 2025, a further 10% was added, bringing the levy to 25%. Then, with the agreement between Washington and Brussels that came into force on 7 August, tariffs were brought back down to 15%. A solution that was supposed to simplify the framework and restore stability.

But the reality has been different. According to the rules, in fact, a quota of European cheeses can enter the American market with the reduced tariff of 15%. Beyond that limit, on the excess amount, a fixed duty of about €2.2 per kilo applies. A mechanism that already appears complicated in itself, but which the US customs authorities have further aggravated by requiring the payment of both the 15% tariff and the fixed cost, in effect doubling the fiscal burden on imports.

The voice of the consortia: erroneous application

Reactions from the production sector were not long in coming. Nicola Bertinelli, president of the Parmigiano Reggiano Consortium, denounced “the erroneous application of an additional 15% tariff, which in practice doubled the customs cost, without respecting the agreement of a 15% all-inclusive”. Thanks also came from the Grana Padano Consortium to the Foreign Minister, Antonio Tajani, for his prompt intervention, with director general Stefano Berni stressing how the customs of New York and New Jersey are interpreting the agreements “in an excessively punitive manner”.

The difference is not negligible: on a cheese imported outside the licences, the entry cost can reach $5 per kilo, almost 30% of the value of the goods. “In reality – explains Berni – only one of the two tariffs must be applied, the one less favourable for the importer, but in any case just one, and not both added together.”

Economic and political weight of overlapping rules

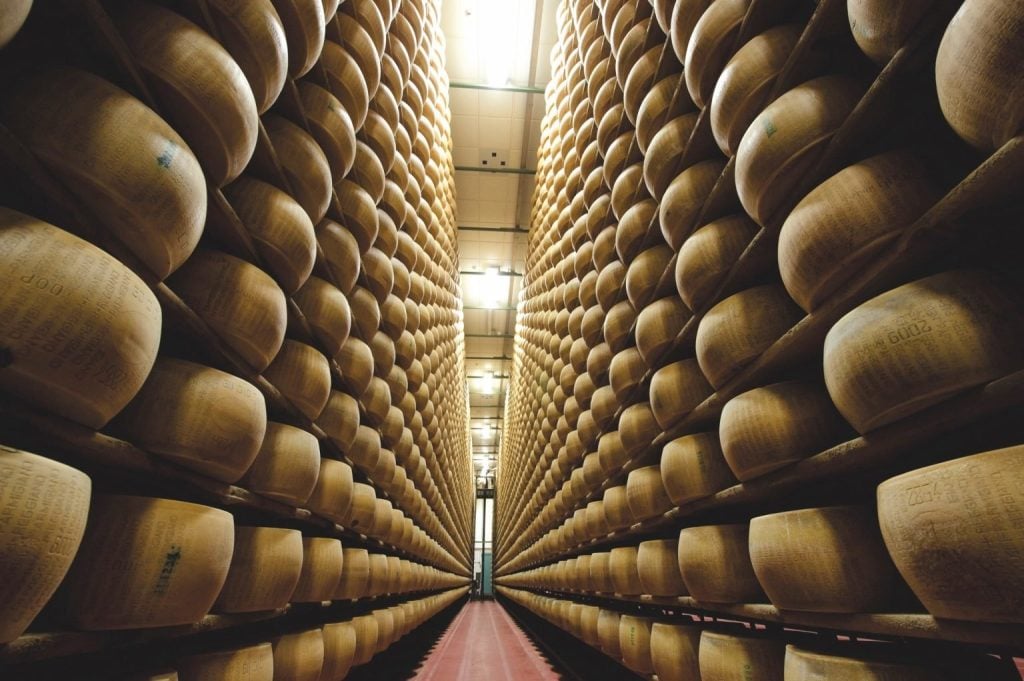

The issue is not only technical. More than 35% of Parmigiano Reggiano and Grana Padano destined for the US market falls outside import licences: about 200,000 wheels weighing 39–40 kilos each. A huge economic asset that risks being entangled in a bureaucratic dispute.

The tariff problem, in fact, does not only concern companies but has political and diplomatic repercussions. Italy and the European Union are confident that clarification will arrive quickly, avoiding frictions in an already complex phase of trade relations with Washington. In the meantime, producers remain suspended between shifting rules, interpretable documents and costs that change from one day to the next, in a context that would instead require certainty and stability.

Vuoi che in questi testi economico-istituzionali mantenga sempre i termini italiani come consorzio di tutela, Dop, Farnesina, ecc., oppure preferisci che li adatti (es. PDO, Ministry of Foreign Affairs) per maggiore chiarezza internazionale?

'You cannot ignore a country of more than 230 million people'

'You cannot ignore a country of more than 230 million people' 'I drink wine with Sprite,' confesses Lionel Messi

'I drink wine with Sprite,' confesses Lionel Messi The Consorzio Vino Chianti heads to Nigeria: 'A historic step towards opening new routes for Italian wine'

The Consorzio Vino Chianti heads to Nigeria: 'A historic step towards opening new routes for Italian wine' 'The Mercosur agreement is also good for Prosecco'

'The Mercosur agreement is also good for Prosecco' The bottle where Vino Nobile di Montepulciano meets Milanese design

The bottle where Vino Nobile di Montepulciano meets Milanese design