“Focus on finalconsumption, not shipments.” This is the warning from the Unione Italiana Vini (UIV), which—following the publication of Istat data on a mixed two-month export performance for Italian wine abroad—speaks of “a negative spiral already long evident in outlooks concerning real consumption, which is now also reflected in export data, up to now inflated by the US rush to stockpile ahead of tariffs.”

The gap between shipped and consumed is steadily narrowing, highlighting the sector’s growing difficulties. This is confirmed by quarterly Customs data, analysed by the UIV Observatory and relating to shipments to non-EU countries, which show a year-on-year volume drop of nearly 9% (-0.1% in value), despite the USA showing +4% (although it ended March on a downward trend). Without the performance in the US, the decline in markets some hoped would counterbalance the slowdown across the Atlantic would approach -17%.

Tariff effect misled the market

According to UIV President Lamberto Frescobaldi, the stockpiling race misled the markets—and in many cases, also Italian policymakers:

“In the past six months we have witnessed a seeming paradox,” he comments. “Italian shipments to the United States appeared to hold up or even grow in certain sectors, but the real consumption data tell a different, much more worrying story. The pre-tariff rush misled the markets, but the situation is different: final consumption is falling or, at best, stagnant. It is therefore essential,” Frescobaldi added, “not to confuse outgoing exports with actual consumption, because the real analysis must focus on the end consumer’s behaviour, not just on customs data. The risk is a false perception of market solidity, which can lead to poor decisions along the entire supply chain.”

Lamberto Frescobaldi

A call for political dialogue

Frescobaldi’s appeal to politics is clear: don’t rest on your laurels, bolstered by end-of-year figures, at a time of serious concern over the future of transatlantic relations. For the first time, partly due to the mid-month tariff threat, there’s a trend reversal (volumes down by 3.5%) in exports to the American market. The future, under a tariff regime, looks complex.

“The super-premiumsegment — €15/litre at the winery—accounts for only 2% of volumes and 8% of the value of our wines in the US,” explains UIV Secretary General Paolo Castelletti. “It would be dangerous to cling to the idea of irreplaceability due to our product’s high-end positioning. Made in Italy exports are fundamentally based on a well-balanced price-quality ratio. We urgently need to engage with institutions to implement real protections for the sector.”

Shelf sales falling in Italy too

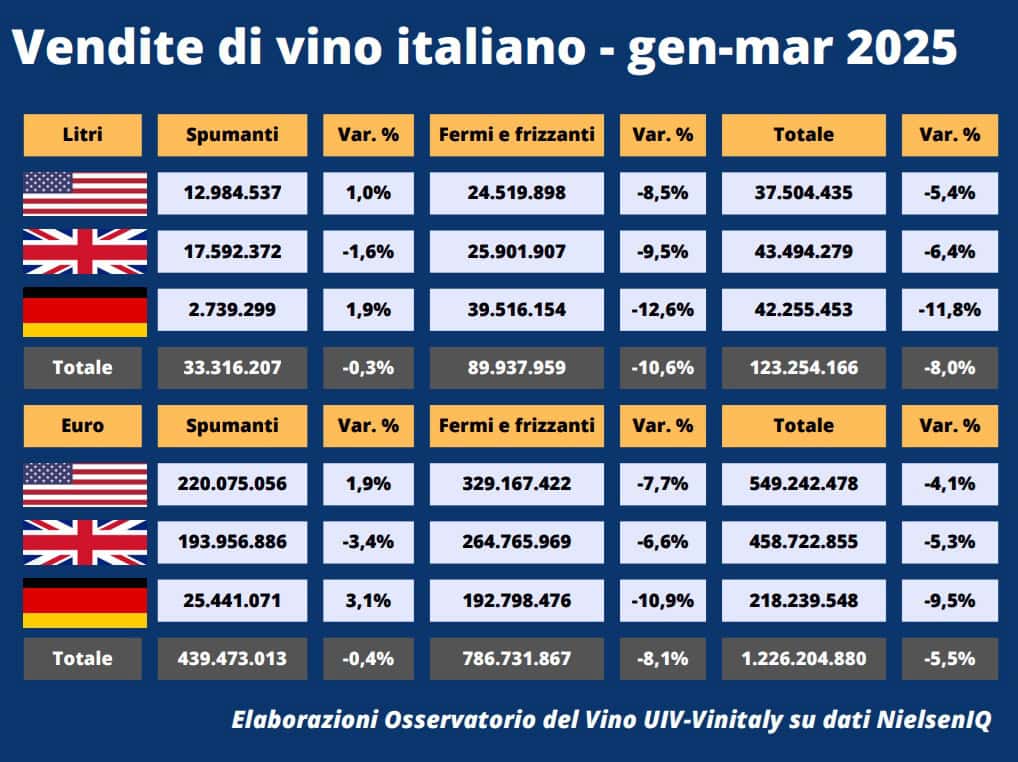

It’s not only the United States causing concern. In the large-scale retail and supermarket sector, UIV Observatory’s Nielsen-based analysis shows that in the first quarter, the top three global markets (USA, Germany, and the UK) experienced year-on-year volume declines of 8% (-5.5% in value), with the US at -5.4%, Germany at -11.8%, and the UK at -6.4%. Nearly all major appellations are struggling, with the exception of Prosecco: from Pinot Grigio delle Venezie to Chianti, from Lambrusco to Piedmont reds and Sicilian whites.

Italy is no exception. In supermarkets, volumes declined by around 4% in the quarter, and even greater drops are forecast in the restaurant sector.

The woman who reclaimed a centuries-old abandoned olive grove on the Sorrento coast

The woman who reclaimed a centuries-old abandoned olive grove on the Sorrento coast Where to eat ice cream in Palermo

Where to eat ice cream in Palermo Italian wine exports slow down: values rise in February but volumes drop. Russia collapses

Italian wine exports slow down: values rise in February but volumes drop. Russia collapses Pop counter and fine dining restaurant. The wine bar just a stone’s throw from the Colosseum where Italy and France meet

Pop counter and fine dining restaurant. The wine bar just a stone’s throw from the Colosseum where Italy and France meet Barbara Ferro is the new CEO of Veronafiere. She will lead the organisation in the post-Danese era

Barbara Ferro is the new CEO of Veronafiere. She will lead the organisation in the post-Danese era