Hopes were for a 2024 at least slightly better than 2023, but this has not been the case. Production, consumption, and vineyard surface area have continued the downward trend of recent years, with only international trade managing in some way to withstand the impact of an unfavourable economic context.

The data presented on Tuesday 15 April by OIV Director General John Barker illustrate a year—the one just ended—described as "challenging" by the leaders of the International Organisation of Vine and Wine, in their usual presentation of the global market overview. The wine sector must inevitably come to terms with climate change (2024 was the hottest year in Europe, according to Copernicus data) and with socio-economic factors that are leading many key markets to reduce purchases, while consumers, struggling with rising prices and increasingly adopting health-conscious behaviours, are changing habits.

Global vineyard in decline: uprooting takes its toll

In 2024, the erosion of the world vineyard continued, falling to 7.1 million hectares (-0.6% on 2023), marking its fourth consecutive decline. Contributing significantly to this were vineyard uprootings in several wine-producing areas in both the southern and northern hemispheres, affecting wine grapes (with the greatest impact) as well as table and raisin grapes (as in the case of Turkey). The EU-27, with 3.2 million hectares, remains the global leader, led by Spain (930,000 hectares, -1.5%), France (783,000 hectares, -0.7%) and Italy (728,000 hectares, +0.8%).

China, the world’s third-largest vineyard with 753,000 hectares—ahead of Italy—lost a further 0.4% in 2024 (down from 770,000 hectares in 2015). Vineyards in the Americas also declined, including the United States, Argentina, and Chile, while Brazil saw growth for the fourth consecutive year. Noteworthy is the growth of India’s vineyard, reaching 185,000 hectares in 2024 with an annual growth rate of 4.5% since 2019.

“Volatile” production at the mercy of the climate

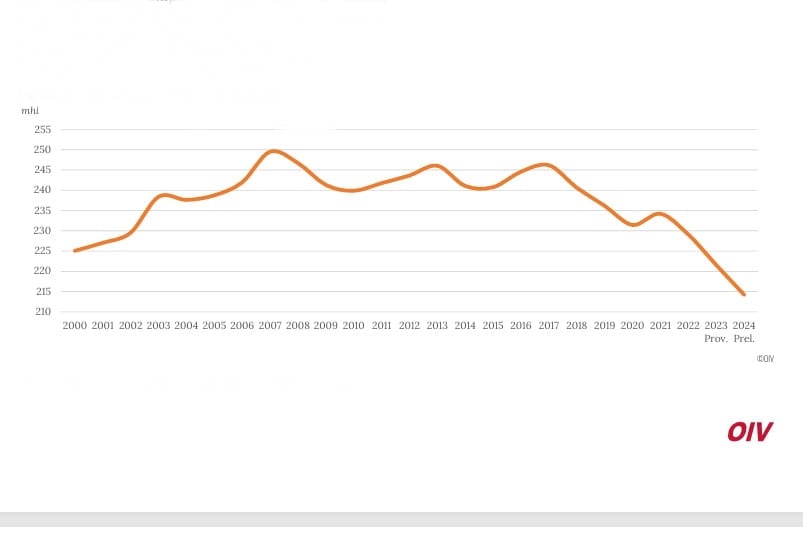

Global wine production (excluding grape juices and musts) is once again entering a period of high volatility, the OIV noted, and is estimated at 225.8 million hectolitres, down 4.8% on a 2023 already at historic lows. This is the lowest level since 1961 (just 219 million hectolitres). Late frosts, heavy rainfall, and prolonged drought affected both hemispheres of the globe.

The EU-27 lost 3.5% of volumes, with Italy—Europe and the world’s top producer—reaching 44.1 million hectolitres, a recovery of 15% from a dismal 2023 (though -6% below the five-year average). France saw a drop of -23.5%, the worst figure since 1957 (due to climate and uprootings). Spain gained 9.3% to reach 31 million hl, thanks to a good harvest in Castilla-La Mancha. Negative signs came from Germany, Portugal, Romania, while Russia recovered 19% to 5.4 million hl. China is estimated at 2.6 million hl (-17%); the United States dropped by a double-digit 17.2%.

In the Southern Hemisphere, wine production in 2024 fell by 3.6% (45.8 million hl), due to negative results in Chile, Brazil, and South Africa. Argentina (with 10.9 million hl) recovered 23.3% of its volumes. In Oceania, Australia’s +5.3% (10.2 million hl) was offset by New Zealand’s -21.2%, as its vineyards were hit by a significant late frost. Initial production estimates for 2025 in this hemisphere show a +2.6% increase, to 47 million hectolitres: all countries are recovering, except Chile. This would be the first positive sign after four consecutive negative years.

Consumption at historic lows: prices also to blame

There’s no getting around it. Wine consumption is at historic lows. According to OIV data, 2024 closed at 214.2 million hectolitres, down 3.3% on 2023. This is the worst level since 1961 (213.6 million hl): a negative record that, at this rate, could be surpassed next year. Central to this is the drop in the Chinese market, which has been losing 2 million hectolitres a year since 2018. Several concurrent factors, according to Director Barker, have contributed to the general situation: pandemic lockdowns, geopolitical tensions, inflationary pressures following the energy crisis after the 2022 Russia-Ukraine war, and reduced consumer purchasing power in the face of rising prices and underwhelming harvests in 2023 and 2024. Wine sales have also dropped in mature markets, due to a combination of structural trends and short-term economic factors.

Wine consumption in the United States drops by 5.8%

Among the top wine-consuming countries, the United States stands out with a -5.8% (33.3 million hl), remaining the world’s leading market in 2024, followed by France at -3.6%. Italy bucks the trend with +0.1% (22.3 million hectolitres and 47.2 litres per capita), then Germany and the UK with -3% and -1% respectively, while Spain (+1.2%) and Russia (+2.4%) show growth.

China continues its decline —now no longer news—falling to tenth place among global consumers, with -19.3% for a market representing just 2.6% of global consumption. Double-digit declines were also seen in Canada (-6.4%), the Netherlands (-8.1%), Brazil (-10.1%), Romania (-11.4%), with Switzerland and Japan also losing between 4% and 5% of volumes.

Global Wine Consumption – OIV Data 2000–2024 (in million hectolitres)

Encouraging signs from global trade

There is some good news. Global wine trade has felt the effects of high prices and generally declining demand. In 2024, export volumes fell by just -0.1% (to 99.8 million hl), thanks to recoveries in Chile, Australia, and Portugal, which balanced out declines in Spain, Canada, and Germany. In value terms, the result was -0.3% to €35.9 billion. This remains a high turnover, close to 2023 levels. Moreover, the internationalisation index of trade rose to 47%. "This," said Barker, "is a positive and encouraging sign." The average price per litre was €3.60, slightly down from the previous year. This trend, according to the OIV, reflects the recent acceleration of the "premiumisation" phenomenon and the effect of low production pushing global wine prices higher. Italy leads the volume export ranking (21.7 million hl) while France tops value exports (€11.7 billion), though down 2.4% compared to 2023.

Sparkling wine trade remains flat

Looking at individual categories, bottled wine accounted for half of global traded volumes in 2024, representing 67% of the value. This category lost 1.8% in quantity and remained stable in value, with prices up by nearly 2%. Sparkling wines were flat in volume and lost 3.7% in value compared to 2023 (average price €7.90/litre, down 3.4%). Bag-in-box sales performed poorly (-5% in volume and -4.8% in value), representing 3.6% of global trade by volume. Lastly, bulk wine sold worldwide (containers over 10 litres) increased by 3.3% in volume and a significant 9.8% in value, accounting for 34.7% of all traded wine, with price lists rising 6.3% in 2024.

John_Barker ceo Oiv

US tariffs pose a threat to market stability

Regarding import duties imposed by the Trump administration, Director General Barker explained that additional tariffs could have "consequences for every market. Today," he stressed, "one in two bottles of wine is sold far from where it was produced, and this uncertainty doesn’t help business. The market must be an opportunity for everyone and is based on reciprocal rules." On the consumption downturn, Barker explained that in recent years the market has been heavily influenced by climate trends, poor harvests, and inflation, which is among the most impactful factors behind declining wine purchases. "Nonetheless, such a scenario," he said, "is also an opportunity for businesses to improve wine quality and reach new consumers, even with new forms of communication."

Despite the numerous negative indicators, the OIV Director General does not believe the 2024 outlook reflects the conditions for a deep structural crisis: "We also see positive elements, such as the resilience of export value, even compared to past decades. The trend of premiumisation is also a good sign. Consumption remains diversified across 195 markets, with varied trajectories. We cannot say we are in the midst of a deep wine crisis: even the data on stocks shows the situation is close to balance, as there is no overproduction. In fact, the impression is that we are in a phase of underproduction." Looking ahead, inflation is expected to fall, and this factor "could progressively," Barker concluded, "contribute to a recovery in consumption."

The Consorzio Vino Chianti heads to Nigeria: 'A historic step towards opening new routes for Italian wine'

The Consorzio Vino Chianti heads to Nigeria: 'A historic step towards opening new routes for Italian wine' 'The Mercosur agreement is also good for Prosecco'

'The Mercosur agreement is also good for Prosecco' The bottle where Vino Nobile di Montepulciano meets Milanese design

The bottle where Vino Nobile di Montepulciano meets Milanese design Pinot Noir overtakes other red grapes in Oltrepò Pavese

Pinot Noir overtakes other red grapes in Oltrepò Pavese What does 2026 hold for New York pizza?

What does 2026 hold for New York pizza?